Navigating the Inflation Wave: Tips for Investors

Inflation can have a significant impact on your investments, but with the right strategies in place, you can navigate the inflation wave and protect your portfolio. As prices rise, the value of your money decreases, making it essential to adjust your investment approach to stay ahead of inflation. Here are some tips for investors looking to manage their investments in times of inflation:

1. Diversify Your Portfolio

One of the best ways to protect your investments during inflation is to diversify your portfolio. By spreading your investments across different asset classes, you can reduce your risk exposure and mitigate the impact of inflation on your overall portfolio. Consider investing in a mix of stocks, bonds, real estate, and commodities to ensure that you are well-positioned to weather the inflation storm.

2. Focus on Real Assets

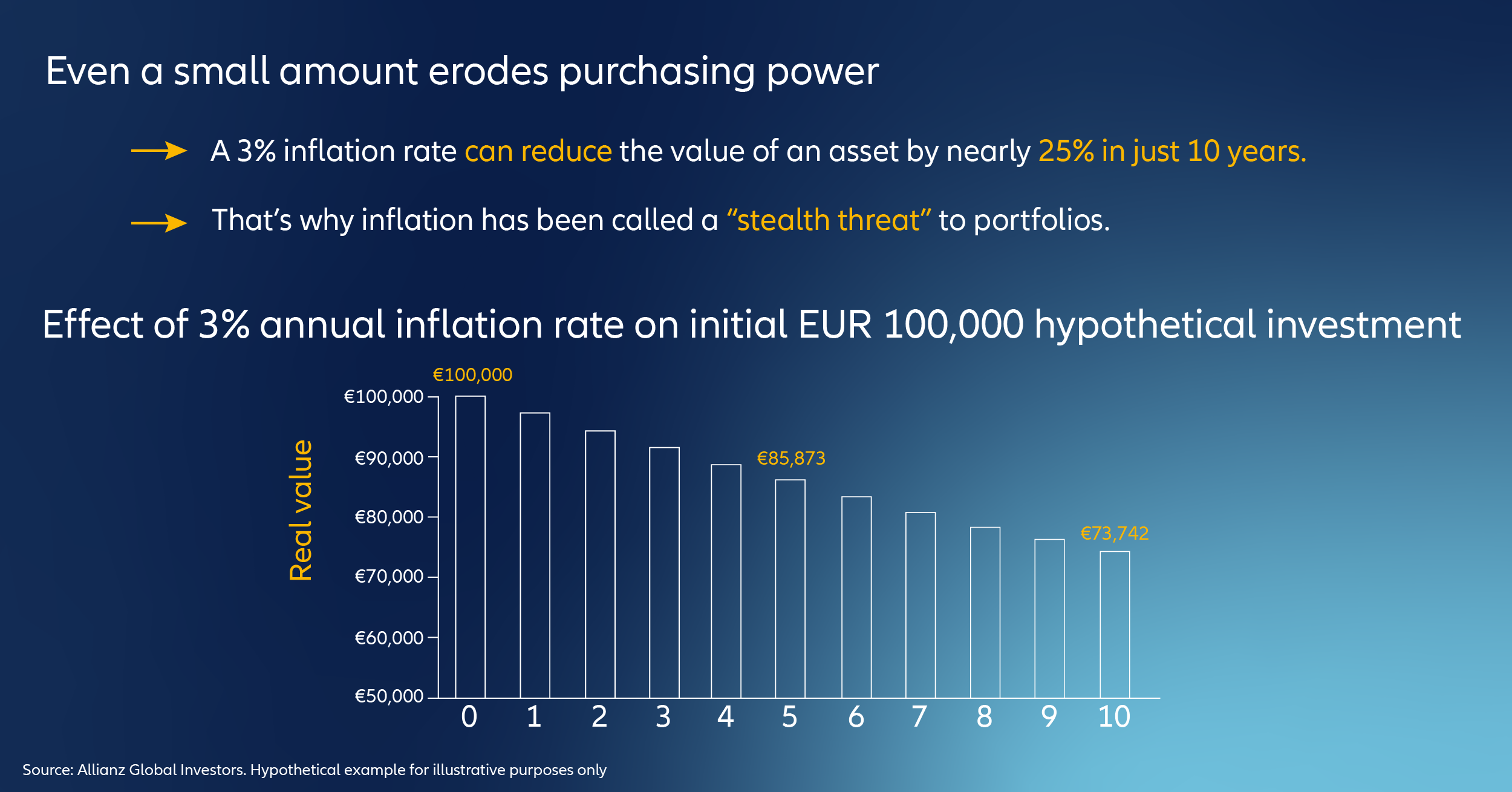

Image Source: allianz.com

During times of inflation, real assets tend to outperform financial assets. Real assets such as real estate, commodities, and precious metals have intrinsic value that can help protect your investments from the erosive effects of inflation. Consider allocating a portion of your portfolio to real assets to hedge against inflation and preserve your wealth.

3. Invest in Inflation-Protected Securities

Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), are specifically designed to safeguard investors against inflation. These securities adjust their principal value based on changes in the Consumer Price Index (CPI), ensuring that your investment keeps pace with inflation. By including TIPS in your portfolio, you can protect your investments from the eroding effects of rising prices.

4. Monitor Your Investments Regularly

In times of inflation, it is crucial to stay vigilant and monitor your investments regularly. Keep a close eye on market trends, economic indicators, and inflation rates to make informed decisions about your portfolio. By staying informed and proactive, you can adjust your investment strategy as needed to protect your assets and capitalize on opportunities in the market.

5. Consider Investing in Dividend-Paying Stocks

Dividend-paying stocks can be a valuable addition to your portfolio during times of inflation. Companies that pay consistent dividends tend to have stable cash flows and strong fundamentals, making them resilient to inflationary pressures. By investing in dividend-paying stocks, you can generate a reliable income stream and potentially outperform the market in inflationary environments.

6. Maintain a Long-Term Perspective

Inflation can be a short-term disruption in the market, but it is essential to maintain a long-term perspective when managing your investments. Avoid making impulsive decisions based on short-term fluctuations and focus on your long-term investment goals. By staying disciplined and sticking to your investment strategy, you can navigate the inflation wave and build a resilient portfolio that withstands economic uncertainties.

7. Seek Professional Advice

If you are unsure about how to manage your investments in times of inflation, consider seeking professional advice from a financial advisor. A knowledgeable advisor can help you develop a tailored investment strategy that aligns with your financial goals and risk tolerance. By working with an expert, you can gain valuable insights and guidance to protect your investments and navigate the challenges of inflation.

In conclusion, managing your investments in times of inflation requires a proactive approach and thoughtful consideration of your investment strategy. By implementing these tips and staying informed about market trends, you can protect your portfolio from the erosive effects of inflation and position yourself for long-term financial success. Stay ahead of the inflation wave and safeguard your investments with these practical tips for investors.

Stay Ahead of Inflation: Manage Your Investments now!

Inflation is a reality that all investors must face at some point. It is the rise in the prices of goods and services over time, leading to a decrease in the purchasing power of money. Inflation can erode the value of your investments if you do not take proactive steps to protect them. As an investor, it is crucial to stay ahead of inflation and manage your investments effectively to ensure that your hard-earned money is not eroded over time.

One of the key strategies for managing your investments in times of inflation is diversification. Diversifying your investment portfolio across different asset classes can help mitigate the impact of inflation on your investments. By spreading your investments across various asset classes such as stocks, bonds, real estate, and commodities, you can reduce the risk of losing money when inflation hits.

Another important tip for managing your investments in times of inflation is to focus on long-term growth. While it may be tempting to make short-term investments to try and outpace inflation, it is essential to remember that investing is a marathon, not a sprint. By focusing on long-term growth and staying invested through market fluctuations, you can ride out the effects of inflation and potentially grow your wealth over time.

In addition to diversification and focusing on long-term growth, it is also important to regularly review and rebalance your investment portfolio. As inflation rates change, some asset classes may outperform while others underperform. By regularly reviewing your portfolio and rebalancing it to align with your investment goals and risk tolerance, you can ensure that your investments are well-positioned to weather the effects of inflation.

One strategy for managing investments in times of inflation is to invest in inflation-protected securities. These securities, such as Treasury Inflation-Protected Securities (TIPS), are designed to provide investors with a hedge against inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI). By including these securities in your investment portfolio, you can help protect your investments from the erosive effects of inflation.

In addition to investing in inflation-protected securities, another strategy for managing investments in times of inflation is to invest in assets that tend to perform well during inflationary periods. These assets, such as commodities like gold and silver, real estate, and infrastructure investments, can provide a hedge against inflation and potentially even outperform during periods of rising prices.

As an investor, it is crucial to stay informed about economic conditions and how they may impact your investments. By staying ahead of inflation and managing your investments effectively, you can protect your wealth and potentially even grow it over time. Remember, investing is a long-term commitment, and by taking proactive steps to manage your investments in times of inflation, you can set yourself up for financial success in the future.

The Impact of Inflation on Your Investments and How to Protect Yourself