Unveiling the Hottest Investment Trends of 2022

As we look ahead to the year 2022, it’s important for investors to keep a close eye on the latest trends that are shaping the investment landscape. With the global economy in a state of flux and markets experiencing unprecedented volatility, staying ahead of the game is essential for maximizing returns and minimizing risk. In this article, we will explore some of the hottest investment trends of 2022 and what they mean for investors.

One of the top investment trends of 2022 is the rise of sustainable and ESG (Environmental, Social, and Governance) investing. With climate change becoming an increasingly urgent issue and consumers demanding more socially responsible practices from corporations, companies that prioritize sustainability are poised to outperform their peers. Investors who embrace this trend can not only feel good about making a positive impact on the world but also potentially see strong returns on their investments.

Another key trend to watch in 2022 is the continued growth of the technology sector. With advancements in artificial intelligence, cybersecurity, and e-commerce shaping the way we live and work, tech companies are at the forefront of innovation and are likely to see continued growth in the coming year. Investing in tech stocks or exchange-traded funds (ETFs) can be a smart way to capitalize on this trend and potentially benefit from the rapid pace of technological change.

Cryptocurrency and blockchain technology are also expected to be major players in the investment landscape in 2022. With the rise of digital currencies like Bitcoin and Ethereum, as well as the increasing adoption of blockchain technology in various industries, investors have more opportunities than ever to participate in this fast-growing market. While the volatility of cryptocurrencies can be a concern, those who are willing to take on some risk may find that the potential rewards are well worth it.

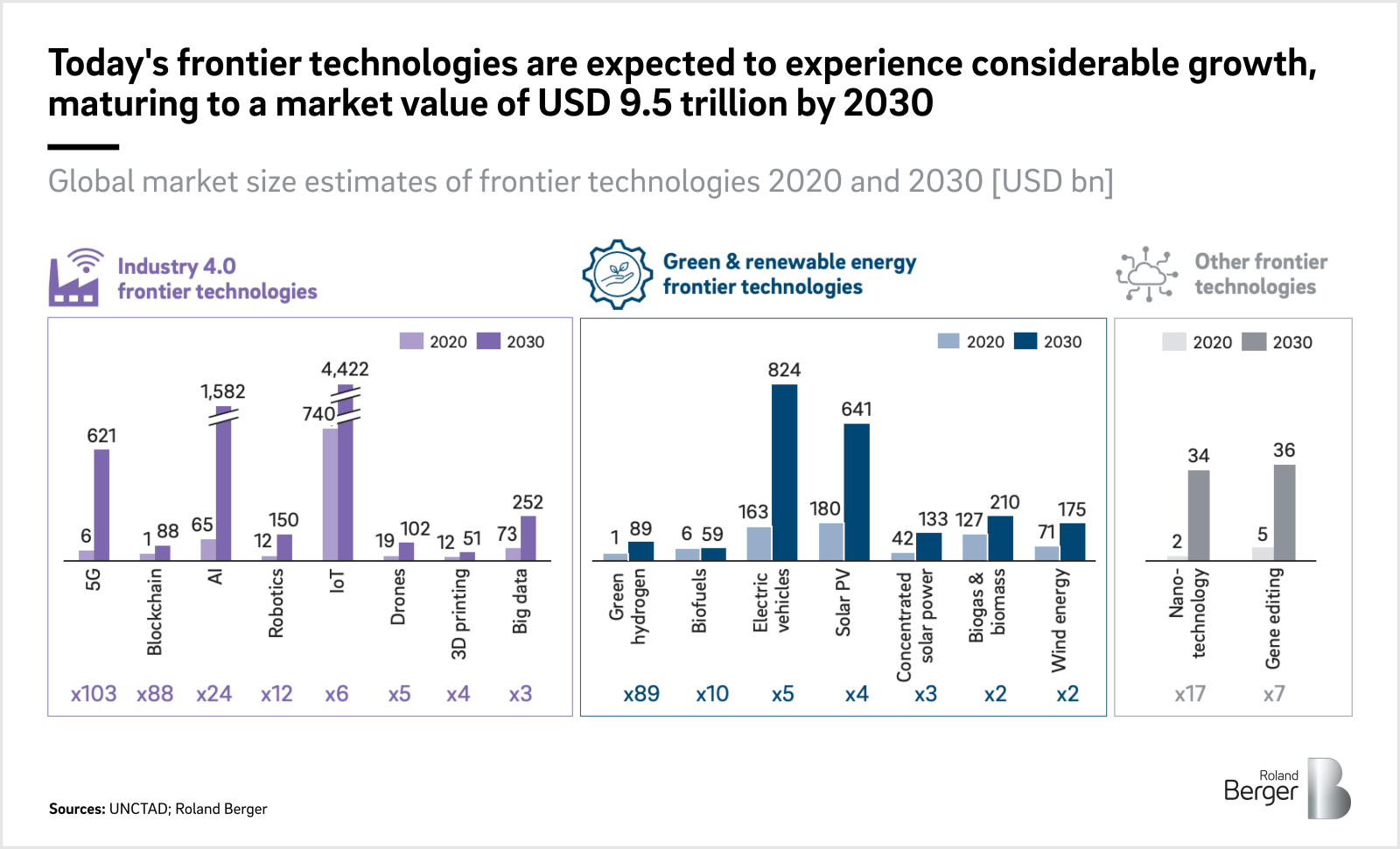

Image Source: rolandberger.com

Real estate is another area to watch in 2022, as the housing market continues to experience strong demand and limited supply. With interest rates remaining low and remote work becoming more common, many individuals are looking to invest in real estate as a way to build wealth and generate passive income. Whether it’s purchasing rental properties, investing in real estate investment trusts (REITs), or flipping homes, there are plenty of opportunities for investors to profit from the current state of the housing market.

In addition to these specific trends, it’s also important for investors to keep a close eye on macroeconomic factors that could impact the overall investment landscape. Geopolitical tensions, inflation rates, interest rate changes, and global economic growth are just a few of the factors that can influence the performance of various asset classes. By staying informed and being proactive in their investment strategies, investors can position themselves to capitalize on opportunities and mitigate risks in the year ahead.

In conclusion, the year 2022 is shaping up to be an exciting time for investors, with a wide range of trends and opportunities to consider. By staying ahead of the game and keeping a close eye on the hottest investment trends of the year, investors can position themselves for success and potentially see strong returns on their investments. Whether it’s embracing sustainable investing, capitalizing on the growth of the tech sector, or exploring opportunities in real estate and cryptocurrencies, there are plenty of ways for investors to diversify their portfolios and achieve their financial goals in the year ahead.

Stay Ahead of the Game with These Investment Insights

As we approach the new year, it’s essential to keep a close eye on the top investment trends that are expected to dominate the market in the year ahead. With the ever-changing landscape of the global economy and financial markets, staying ahead of the game and being informed about the latest investment insights is crucial for success in the world of finance.

One of the key investment insights to focus on in the coming year is the rise of sustainable and ESG (environmental, social, and governance) investing. As the world becomes more conscious of the impact of climate change and social issues, investors are increasingly looking for opportunities to align their values with their investment portfolios. Companies that prioritize sustainability and social responsibility are likely to outperform in the long run, making them attractive investment options for those looking to make a positive impact while also generating a healthy return on investment.

Another important trend to watch out for in the year ahead is the continued growth of the technology sector. With advancements in artificial intelligence, cybersecurity, and e-commerce, technology companies are expected to see significant growth and innovation in the coming year. Investing in tech stocks or mutual funds that focus on the technology sector can provide investors with the opportunity to benefit from the rapid pace of technological change and capitalize on the industry’s potential for growth.

In addition to sustainable investing and technology, another investment trend to keep an eye on in 2022 is the rise of alternative assets. With traditional investments like stocks and bonds facing increased volatility and uncertainty, many investors are turning to alternative assets such as real estate, precious metals, and cryptocurrencies to diversify their portfolios and hedge against market risks. Alternative assets can provide investors with unique opportunities for growth and protection against market downturns, making them an attractive option for those looking to think outside the box when it comes to their investment strategy.

Furthermore, the healthcare sector is another area to watch in the year ahead. With the ongoing COVID-19 pandemic highlighting the importance of healthcare infrastructure and innovation, companies in the healthcare industry are expected to see continued growth and demand for their products and services. Investing in healthcare stocks or healthcare-focused mutual funds can provide investors with exposure to this resilient and essential sector of the economy, offering potential for growth and stability in the face of global challenges.

Overall, staying ahead of the game with these investment insights can help investors navigate the complexities of the financial markets and capitalize on opportunities for growth and success in the year ahead. By keeping a close eye on sustainable investing, technology trends, alternative assets, and the healthcare sector, investors can position themselves for success and stay ahead of the curve in an ever-changing and dynamic market environment. So, take note of these investment insights and get ready to make the most of the exciting opportunities that lie ahead in the year to come.

Top Investment Trends to Watch in the Coming Year