Navigate Global Markets with Confidence

Embarking on international business ventures can be both exciting and intimidating. The thought of expanding your reach to global markets opens up a world of opportunities, but it also comes with a myriad of challenges and regulations to navigate. However, with the right knowledge and understanding of international business regulations, you can confidently steer your way through the complexities of global markets.

In today’s interconnected world, businesses of all sizes are increasingly looking beyond their domestic borders to tap into new markets and grow their operations. Whether you are a small startup or a multinational corporation, understanding and complying with international business regulations is crucial to your success. From trade agreements to tax laws, intellectual property rights to labor laws, there are a multitude of regulations that can impact your business operations in foreign markets.

One of the key aspects of navigating global markets with confidence is staying informed about the regulatory environment of the countries you are doing business in. Each country has its own set of rules and regulations governing various aspects of business, and it is important to familiarize yourself with these regulations to ensure compliance. This may involve conducting thorough research, seeking legal advice, and staying up to date with any changes or updates in the regulatory landscape.

Another essential component of navigating global markets with confidence is building strong relationships with local partners and stakeholders. Local knowledge and expertise can be invaluable in helping you understand and navigate the regulatory environment of foreign markets. By collaborating with trusted partners, you can gain insights into local regulations, customs, and business practices, which can help you avoid potential pitfalls and navigate regulatory challenges more effectively.

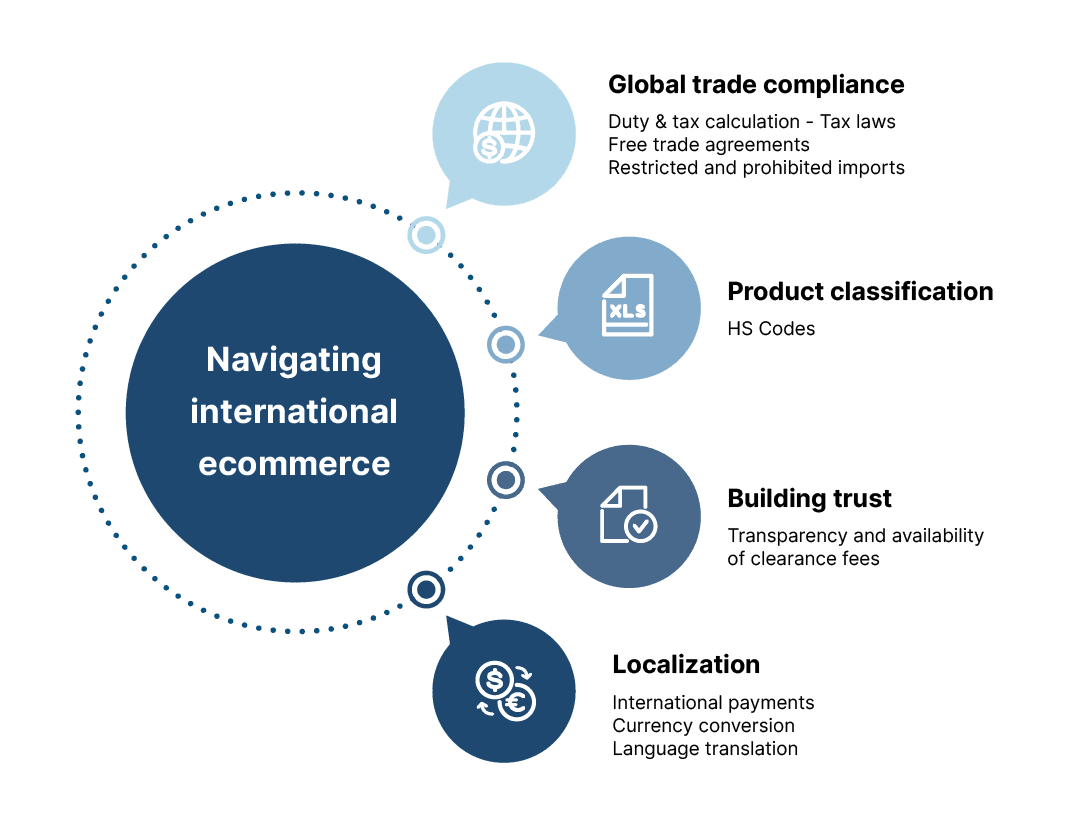

Image Source: zonos.com

In addition to understanding the regulations of individual countries, it is also important to be aware of international agreements and treaties that may impact your business operations. Trade agreements, such as the North American Free Trade Agreement (NAFTA) or the Trans-Pacific Partnership (TPP), can have significant implications for businesses engaged in cross-border trade. By understanding the terms of these agreements and how they affect your business, you can take advantage of opportunities for market access and preferential treatment.

Furthermore, compliance with international business regulations is not just a matter of legal obligation – it can also be a competitive advantage. Businesses that demonstrate a commitment to ethical business practices, environmental sustainability, and social responsibility are increasingly valued by consumers and investors alike. By proactively complying with regulations and adopting best practices, you can enhance your reputation, build trust with stakeholders, and differentiate yourself in the global marketplace.

In conclusion, navigating global markets with confidence requires a deep understanding of international business regulations and a proactive approach to compliance. By staying informed, building strong relationships, and demonstrating a commitment to ethical business practices, you can successfully expand your operations into foreign markets and seize new opportunities for growth. With the right knowledge and mindset, you can confidently navigate the complexities of global markets and achieve success in the international business arena.

Master International Business Regulations

Welcome to the essential guide to international business regulations! In today’s interconnected world, businesses are increasingly expanding their reach across borders to tap into new markets and opportunities. However, with this global expansion comes a complex web of regulations and compliance requirements that must be navigated carefully to avoid legal pitfalls. In this section, we will delve into the key details you need to understand to master international business regulations.

International business regulations encompass a wide range of laws and guidelines that govern how businesses operate in different countries. These regulations cover various aspects of business activities, including trade, investment, employment, taxation, intellectual property, and more. Understanding and complying with these regulations is crucial for businesses to operate legally and successfully on the global stage.

One of the fundamental aspects of international business regulations is trade compliance. Trade regulations differ from country to country and can impact various aspects of a business, such as import/export procedures, tariffs, quotas, and sanctions. Businesses must carefully review and adhere to these regulations to avoid penalties and disruptions to their operations. By mastering trade compliance, businesses can navigate global markets with confidence and expand their reach internationally.

Another important aspect of international business regulations is investment laws. When expanding into foreign markets, businesses must consider the legal requirements for setting up and operating a business in a particular country. This includes understanding laws related to foreign ownership, business structures, capital requirements, and repatriation of profits. By mastering investment laws, businesses can ensure a smooth entry into new markets and mitigate legal risks.

Employment laws also play a critical role in international business regulations. Businesses that hire employees in foreign countries must comply with local labor laws, including regulations on wages, working hours, benefits, and termination procedures. Understanding and following these laws is essential to maintaining a positive work environment, building a strong workforce, and avoiding legal disputes.

Taxation is another key area of international business regulations that businesses must master. Tax laws vary significantly from one country to another and can have a significant impact on a business’s bottom line. Businesses must understand the tax implications of their international operations, including corporate tax rates, withholding taxes, VAT/GST requirements, transfer pricing rules, and tax treaties. By mastering international taxation, businesses can optimize their tax planning strategies and minimize their tax liabilities.

Intellectual property laws are also critical for businesses operating internationally. Protecting intellectual property rights, such as patents, trademarks, copyrights, and trade secrets, is essential to safeguarding a business’s innovations and assets. Businesses must understand the legal frameworks for intellectual property protection in different countries and take proactive measures to secure their intellectual property rights. By mastering intellectual property laws, businesses can protect their competitive advantage and prevent unauthorized use of their creations.

In conclusion, mastering international business regulations is essential for businesses to succeed in today’s global economy. By understanding and complying with trade compliance, investment laws, employment laws, taxation, and intellectual property laws, businesses can navigate global markets with confidence and seize new opportunities for growth. With the right knowledge and expertise, businesses can overcome legal challenges, build strong relationships with international partners, and achieve sustainable success on the international stage.

Navigating International Business Regulations: What You Need to Know